Mastercard Is A Great Business Worth A Look

In this review, we're gonna talk about something that almost everyone enjoys...

Buying stuff!

This company is one that a lot of readers have used today. Possibly several times. And one they will likely use tomorrow, and the day after.

Every time you use it, the company makes money.

Put those two characteristics together, and you have one remarkable business indeed! This combination is very, very rare.

I'm talking about Mastercard (MA). It is one of the more attractive businesses in the world, and it is currently a part of the Green Screens.

It would be neglectful not to take a look at this firm for our Watch List, so let's get to it.

How Mastercard Works

Even if you don't carry a Mastercard, it is nearly certain that you carry a credit or debit card of some sort. These are used to pay for goods and services electronically, and are nearly universally accepted nowadays.

Convenience over cash is the key advantage. Instead of carrying around wads of bills and/or pockets full of change, credit and debit cards allow you to pay from bank funds or on credit lines. It is faster, more secure, and easier. After the COVID-19 pandemic of 2020-21, many places have now moved to electronic payment ONLY, ditching the option to use cash altogether!

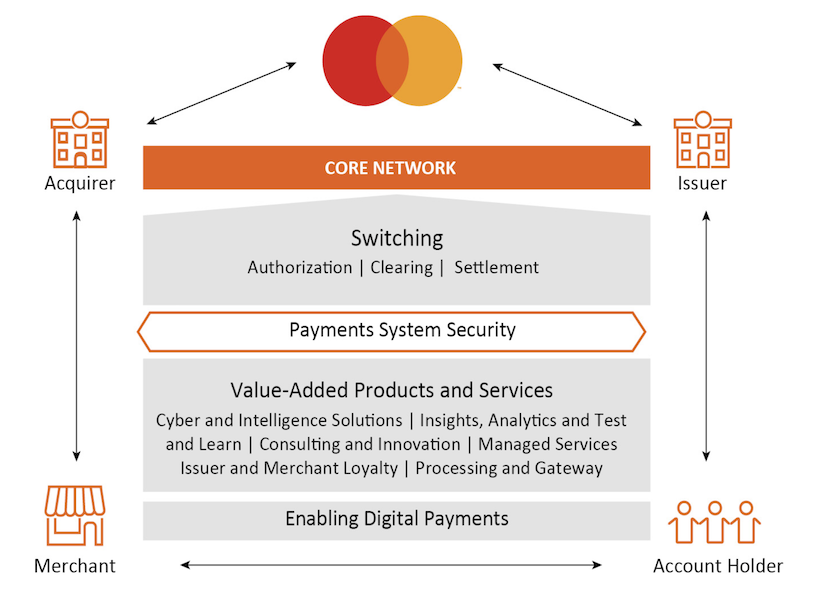

The key thing to realize about Mastercard is that it is a network between financial institutions (banks, credit unions, even digital wallets like PayPal). We will call them "banks" for short-hand, but just remember that the endpoints can be any kind of financial entity.

Mastercard's value to the banks is its connectivity. Without its network, each financial institution would need to create its own way to clear transactions electronically with the thousands of other banks out there. Clearly, that's not a realistic option.

When you pay with Mastercard, the transaction enters the network. Mastercard then checks with the buyer's bank that there are sufficient funds to pay ("authorization"), sets up communication between the buyer and seller's banks ("clearing"), and finally, transfers the money between banks ("settlement").

For these services, Mastercard charges a small, per-transaction fee. These fall into its "transaction processing" category, which is the largest single source of revenue (36%). Also included in this segment are connectivity fees, which is an ongoing subscription fee allowing the banks to continue using Mastercard's network.

The second source of revenues are assessments. Over a period of time (usually a month), Mastercard assesses a percentage fee to every member bank based on how much dollar volume they processed over the network. For transactions that take place within the same country, these are "domestic assessments", and represent 27% of total revenue.

Transactions between countries are "cross-border assessments". These generate a much higher percentage fee on volume, and make up 16% of company revenue.

Finally, "other" revenues are about 21% of sales. These are ancillary services Mastercard can provide, like identifying fraudulent transactions, providing detailed data analytics, supporting loyalty and reward programs, and many other things.

The Power Of The Network

Mastercard is a textbook example of the NETWORK EFFECT economic moat.

With over 3 billion Mastercard, Maestro, and Cirrus cards in circulation, merchants almost HAVE to accept it as a form of payment. In turn, consumers prefer carrying a Mastercard over competitors like Discover because they know nearly all merchants will accept it. This acceptance on both the supply and demand side of the network force every financial institution to join the Mastercard network. If they don't, they will be at a significant disadvantage in keeping clients.

There are 4 global payment processing networks that operate at scale. Visa (V) is the largest, at 48% market share of cards in circulation. Mastercard is second at 36%. Both American Express (AXP) and Discover (DFS) are way behind, with only 8% each. American Express, though, processes far more dollar volume than Discover due to its higher income clients. In fact, it only trails Mastercard by a few percentage points of market share when it comes to dollar volume processed.

It is also important to note that Visa and Mastercard are a true duopoly when it comes to debit cards. Here, Visa's share of purchase volume is 72% and Mastercard's is 28%.

This is no big surprise. Visa, Mastercard, and AMEX were the first 3 companies to establish payment networks in the 1950's and 60's. Once they were ubiquitous enough that nearly all banks joined their networks, and consumers became aware of their brands, there was really no space (or need) for new competitors. Discover came on the scene in the mid-1980's, but even 40 years later hasn't made much inroads. That's how strong the competitive advantages are here. It is a "limited winner" market.

A payment processing network is mostly a fixed cost operation. It costs Mastercard about the same amount of money to process a million payments as it does a billion. This creates an ECONOMIES OF SCALE advantage over smaller networks, and allows it to lower fees in the case of an unlikely price war.

These two advantages have protected Mastercard's business for several decades now, and are likely to prevent any significant new competition for decades to come.

But what about some of the newer payment alternatives, like digital wallets (e.g. PayPal (PYPL)) or app/phone payment offerings like Apple (AAPL) Pay?

The truth is, from Mastercard's perspective, these are just additional nodes on its network. Sure, they may siphon some transactions off, if both the buyer and seller manage funds within them. But the fact of the matter is that most transactions are not going to be PayPal-to-PayPal (for example), and Apple Pay and its ilk are simply layers of convenience and security on top of the existing payment networks.

Given this, I don't see digital wallets or certainly phone/app payments as major threats. In most cases, in fact, they are sources of additional business for Mastercard.

Revenue Characteristics

We discussed Mastercard's revenue model above. Of the 3 main recurring revenue models, this falls squarely into the "toll booth" category. By charging fees based on the volume and dollar amount of transactions processed over its network, Mastercard is taking a small tax every time.

There is also some semblance of the subscription model, given the annual or monthly fees charged for ongoing access and additional products like data analytics.

Either way, there is no question Mastercard is a recurring revenue business.

Let's turn to growth.

Mastercard's compound annual 3 year growth rate looks decent at 9.6%. However, this includes the COVID year of 2020, when consumers were shut indoors, cross-border revenues plummeted, and sales declined over 9%. Taking a wider 5-year sample, sales have growth about 13% annually. Recent quarters has the company posting 14% year-over-year growth. That's well above market-average rates of 6-7%.

I expect continued 10-12% growth over the next 5 years. Digital payments is one of the few nearly "unlimited" markets in the world. Total transaction volume was $8.5 trillion dollars in 2022, and is expected to grow at a 12.3% annual rate through 2027 to reach $15 trillion.

The opportunity is especially attractive in developing economies. Digital payments are expanding rapidly there, with the percentage of adults who have made a digital payment increasing from 35% in 2014 to 57% in 2021. Banking inclusion - a key prerequisite of using a Mastercard - has also increased, with the banked population rising to 76% in 2023, up from just 42% in 2011. This has set the stage for a sustainable increase in worldwide digital payments for the next decade or more.

Mastercard is well positioned internationally, issuing nearly as many cards as Visa outside of the U.S. Combined with its strong network and wide acceptance, this sets the company up well to maintain or increase its share of this growing market.

Leadership and Financial Strength

I like to see one of 3 models when it comes to evaluating management: founder-led, long track record of success, or Warren Buffett's "idiot-proof" business schema.

With Mastercard, the 3rd of these seems apt. Absent some truly terrible management decisions, the business is solid enough to withstand bumps in the road like economic recessions or even once-in-a-century health crises!

The current CEO is Michael Miebach. He took over from Ajay Banga in 2021, after Mr. Banga had led the company successfully for over a decade. Banga today is president of the World Bank.

Despite only 3 years of track record, Miebach's tenure has seen Mastercard perform well, rebounding from COVID to post a 23% growth rate in 2021, and 18% in 2022 - both numbers exceeding results from main rival Visa. He has been with Mastercard for over a decade, serving as Chief Product Officer for 5 years prior to taking over. His tenure with the firm, and good results so far, give us confidence in leadership here.

Financially, there are few businesses more attractive than the large card networks. Mastercard generates free cash flow margins exceeding 44%, and has for many years. Cash return on invested capital is over 40% - simply remarkable for a business of this size!

This cash flow has allowed investments in new initiatives, a steady but small dividend payment (0.6% yield), and regular buybacks that have reduced outstanding share count by 2% annually.

Risks

Although Mastercard is a fantastic business, there are some risks to be aware of.

Regulation is easily the biggest. The oligarchy in consumer credit and debit cards, and its resulting high profit margins, has not gone unnoticed by governments worldwide. The 2010 "Durbin Amendment" settled an anti-trust lawsuit, "swipe fees" have been capped in Europe since 2015, and challenges to its interchange and cross-border fees have been a consistent thorn in the company's side ever since. Any successful legislation that limits the company's ability to charge payment fees is a serious risk to an investment.

Aside from that, the challenges are typical of any other business. Global economic recessions, for whatever reason, will slow consumer spending and hurt Mastercard. Data privacy breaches are a risk, particularly with sensitive payment information. Competition has exploded in financial technology ("fintech"), although many of these new solutions sit on top of the credit card networks instead of competing directly with them. Still, solutions like PayPal, Venmo, Block's (SQ) Cash App, and others have payment solutions that can bypass the card providers entirely.

At large, I would consider Mastercard a "medium-low" risk investment compared to our typical Watch List stock.

Conclusion

Mastercard is a clear "green dot" stock and will be added to the Watch List today! Running a free cash flow valuation, I get a target price of about $420, which is more or less where the stock trades at now. We will wait for a better valuation before buying in.

Information contained on this website represents only the opinions of the author and should not be used as the sole basis for investing decisions. By using this site, you agree to all statements in the Site Policy.

Watch List

| CRWD | 113.61% |

| NTNX | 44.26% |

| VEEV | 13.93% |

| SNOW | 50.86% |

| WDAY | -9.43% |

| ENLT | -10.81% |

| WEAV | -27.40% |

| SE | 36.62% |

| SPSC | 12.33% |

| RDDT | 14.74% |

| APPF | 13.92% |

| CMG | 39.56% |

| INTU | 44.44% |

| PSTG | 12.28% |

Buy List

| TBBB | -35.38% |

| SEMR | -40.13% |

| ZETA | -39.20% |

| GOOG | -45.72% |

| ASR | -29.43% |

| HRMY | -55.45% |

| GLBE | -28.96% |

| YOU | -36.62% |

| MELI | -29.05% |

| ADBE | -39.09% |

Hold List

| PINS | -14.33% |

| ASML | -13.33% |

| VTEX | 3.36% |

| TSM | -24.34% |

| NYAX | -24.98% |

| MSFT | -13.80% |

| ODD | 9.51% |

| FLYW | -16.08% |

| CELH | 32.77% |

| TOST | 38.47% |

| CPNG | 6.04% |

| HIMS | 40.46% |

| PAYC | -6.84% |

| MNDY | 18.12% |

| ZS | 81.90% |

| V | -2.80% |

| ADSK | 5.86% |

| NOW | 19.40% |

| ABNB | -23.85% |

| FTNT | -0.17% |

| TEAM | -15.16% |